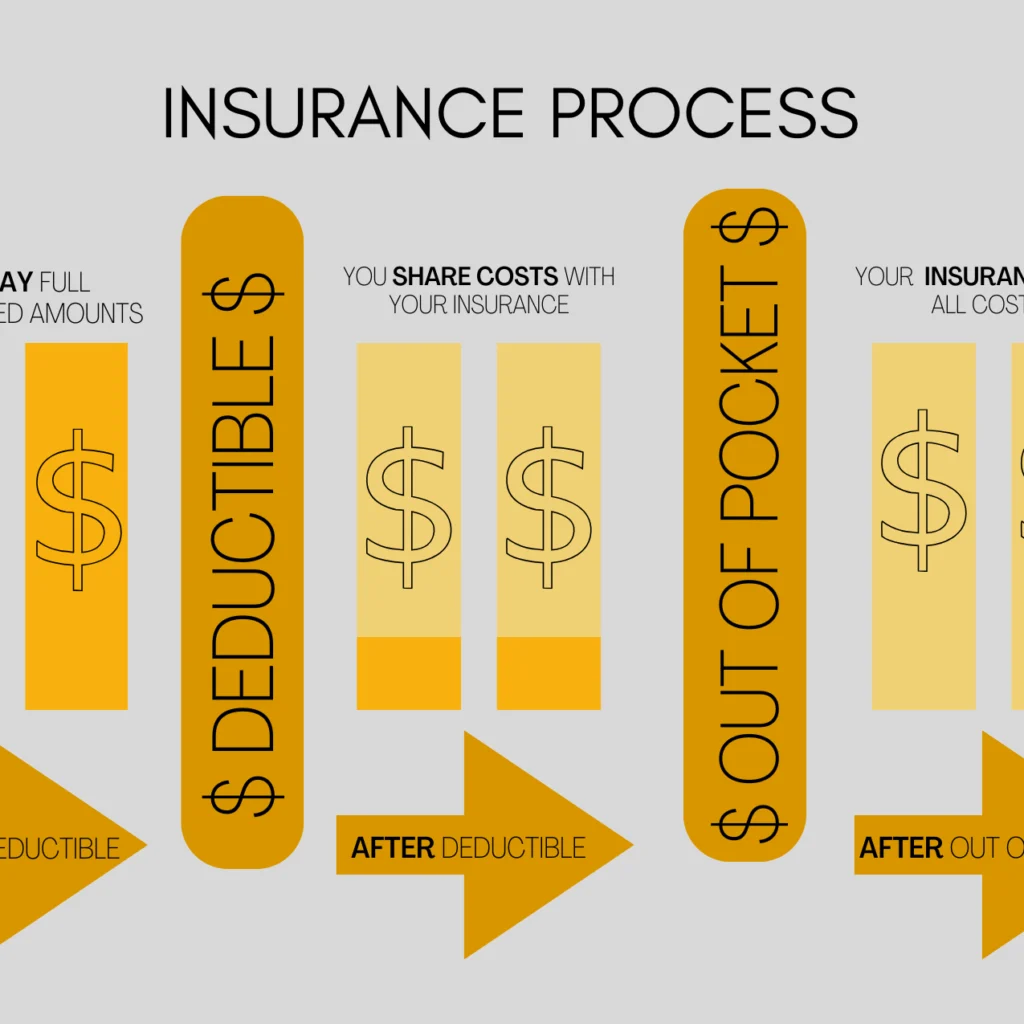

Insurance terminology can feel deliberately confusing, with terms like deductibles, excesses, co-payments, and out-of-pocket maximums creating a maze of concepts that obscure rather than clarify what you’ll actually pay when making claims. Yet understanding these terms isn’t just academic—it directly determines how much money comes out of your pocket when you need your insurance most. Many policyholders discover too late that their insurance costs extend far beyond monthly premiums, with policy deductible amounts and various out-of-pocket insurance expenses creating substantial financial obligations they never anticipated. This disconnect between premium costs and actual claim expenses leads to unpleasant surprises precisely when people are already stressed by whatever circumstances necessitated claiming in the first place.

The confusion intensifies because insurance systems vary significantly across different types of coverage and between regions. In the UK, what Americans call “deductibles” are typically termed “excesses,” while out-of-pocket maximums feature prominently in US health insurance but less commonly in UK insurance products. However, the fundamental concepts of cost-sharing in insurance remain consistent: you pay some portion of claims yourself, either as fixed amounts per incident or as percentages of total costs, before insurance covers the remainder. Understanding how these mechanisms work, what triggers them, and how they interact with your premiums enables informed decisions about appropriate coverage levels while avoiding expensive mistakes.

Policy Deductible Explained: The Basics

It represents the amount you must pay towards a claim before your insurance begins covering costs. Think of it as your share of the claim—insurance only pays amounts exceeding the deductible threshold.

Understanding how deductible explained concepts work in practice:

1. Per-Claim Basis:

Most deductibles apply to each individual claim. If you make multiple claims during a policy period, you pay the deductible for each separate incident.

2. Before Insurance Pays:

The deductible must be satisfied before insurance coverage begins. If your claim is below the deductible amount, insurance pays nothing—you cover the entire cost yourself.

3. Fixed or Percentage:

Deductibles can be fixed amounts or percentages of the claim value. Fixed deductibles remain constant regardless of claim size, while percentage deductibles scale with claim amounts.

4. Mandatory vs Voluntary

Some deductibles are mandatory minimums set by insurers, while voluntary deductibles allow you to choose higher amounts in exchange for reduced premiums.

1. Motor Insurance:

When your vehicle suffers damage, you pay the excess amount before insurers cover the remaining repair costs. If repairs cost less than your excess, you pay everything yourself and insurance pays nothing.

2. Home Insurance:

Claims for property damage or theft require you to pay the excess before insurance covers the balance. Some home policies have different excesses for specific perils—higher excesses for subsidence claims, for instance.

3. Health Insurance:

Private medical insurance often requires excesses on certain treatments or procedures. You pay the initial portion of treatment costs before coverage begins.

4. Travel Insurance:

Claims for cancellations, medical treatment abroad, or lost belongings typically involve excesses that you pay before insurance reimburses the remaining amounts.

5. Business Insurance:

Commercial policies almost universally include deductibles across various coverage types, from property damage to liability claims.

The key insight across all these examples of deductible implementation is that insurance doesn’t cover everything—you always contribute something when claiming.

Out-of-Pocket Insurance Costs: The Broader Picture

While deductibles represent specific, defined amounts you pay per claim, out-of-pocket insurance encompasses all expenses you bear related to insurance beyond premiums. This broader category includes deductibles but extends to additional cost-sharing mechanisms.

Components of out-of-pocket costs include:

- Deductibles/Excesses: Your contribution to each claim before insurance pays.

- Co-Payments: Fixed amounts you pay for specific services, common in health insurance, where you might pay a set fee per GP visit or prescription.

- Co-Insurance: Percentage-based cost sharing where you pay a proportion of costs even after meeting deductibles. For example, insurance might cover a certain percentage of claims, with you responsible for the remainder.

- Coverage Gaps: Expenses for services or items your policy doesn’t cover at all, requiring full out-of-pocket payment.

- Above Policy Limits: Costs exceeding your policy’s coverage limits become out-of-pocket expenses you must bear.

Understanding the full scope of out-of-pocket insurance expenses prevents unpleasant surprises about what you’ll actually pay when circumstances require claiming.

How Deductibles Affect Premiums

The inverse relationship between deductibles and premiums represents insurance’s most fundamental trade-off. Higher deductibles reduce premiums because you’re assuming greater financial responsibility for claims, while lower deductibles increase premiums because insurers bear more risk.

1. Risk Transfer vs Self-Insurance:

Higher deductibles mean self-insuring smaller losses while maintaining catastrophic coverage. Lower deductibles transfer more risk to insurers but cost more in premiums.

2. Frequency of Claims:

If you rarely claim, higher deductibles save money through reduced premiums. Frequent claimants benefit more from lower deductibles despite higher premiums.

3. Financial Capacity:

Higher deductibles only make sense if you can afford them when claiming. Choosing unaffordable deductibles to save on premiums proves counterproductive if you cannot pay when needed.

4. Claim Likelihood:

Assess your realistic claim probability. Low-risk situations favour higher deductibles, while high-risk circumstances warrant lower deductibles despite premium costs.

Cost-Sharing in Insurance: Why It Exists

Insurance operates on principles for sound economic and behavioural reasons. Understanding why deductibles and out-of-pocket costs exist helps frame them as features rather than burdens.

- Moral Hazard Mitigation: When insurance covers everything, policyholders have less incentive to prevent losses or control costs. Deductibles ensure you have a financial stake in avoiding claims, encouraging risk reduction.

- Premium Affordability: If insurance covered every minor loss with no deductibles, premiums would be prohibitively expensive. Deductibles keep premiums manageable by excluding small, frequent claims.

- Administrative Efficiency: Processing numerous small claims costs insurers substantially. Deductibles eliminate claims below certain thresholds, reducing administrative burdens and associated costs passed to policyholders through premiums.

- Risk Selection: Deductibles help insurers attract and retain lower-risk customers who prefer lower premiums and can tolerate higher out-of-pocket costs, while higher-risk individuals who anticipate frequent claims opt for lower deductibles and accept higher premiums.

Understanding the full scope of out-of-pocket insurance expenses prevents unpleasant surprises about what you’ll actually pay when circumstances require claiming.

1. Choose Appropriate Deductible Levels:

Select deductibles you can comfortably afford if claiming, balancing premium savings against potential out-of-pocket costs. Don’t choose deductibles so high that claiming becomes financially impossible.

2. Maintain Emergency Funds:

Build savings specifically for insurance deductibles and out-of-pocket expenses. This financial buffer enables choosing higher deductibles that reduce premiums without creating financial hardship when claiming.

3. Understand Coverage Terms:

Read policy documents thoroughly to identify all potential out-of-pocket costs beyond deductibles. Hidden co-payments, percentage shares, or coverage limitations can create unexpected expenses.

4. Prevent Claims:

The best way to reduce out-of-pocket insurance spending is avoiding claims through risk management. Home security, safe driving, and health maintenance—these reduce claim frequency and associated out-of-pocket costs.

5. Bundle Policies:

Multi-policy discounts reduce overall, insurance costs including premiums, freeing budget for lower deductibles if desired.

6. Annual Policy Reviews:

Reassess deductible choices annually. As financial circumstances improve, you might afford higher deductibles that reduce premiums. Conversely, changing circumstances might warrant lower deductibles despite premium increases.

Calculating Total Insurance Costs

Evaluating insurance options requires calculating total insurance costs, including premiums and anticipated out-of-pocket expenses, not just comparing premium quotes.

- Annual Premium: Your regular payment for maintaining coverage.

- Expected Deductibles: Estimate likely claims and associated deductible costs based on your risk profile and claim history.

- Potential Co-Payments: If applicable to your coverage type, factor in expected co-payment expenses.

- Coverage Gaps: Consider expenses for items or services your policy doesn’t cover.

The policy with the lowest premium might actually cost more overall if high deductibles or extensive cost-sharing create substantial out-of-pocket expenses when claiming. Conversely, expensive comprehensive coverage might waste money if you rarely claim and could comfortably afford higher deductibles.

Common Misconceptions About Deductibles

Confusion about deductibles leads to poor decisions and unexpected costs. Clarifying common misconceptions improves understanding.

1. Deductibles Are Annual:

Many assume deductibles apply once yearly, regardless of claim frequency. In reality, most deductibles apply per claim, meaning multiple claims trigger multiple deductible payments.

2. Lower Deductibles Always Better:

While lower deductibles reduce out-of-pocket costs when claiming, they substantially increase premiums. For infrequent claimants, higher deductibles often prove more economical.

3. Insurance Covers Everything After Deductible:

Even after meeting deductibles, co-insurance, coverage limits, and exclusions can create additional out-of-pocket costs.

4. Deductibles Are Negotiable:

While you can choose from available deductible options offered by insurers, you cannot arbitrarily negotiate custom deductible amounts beyond their standard offerings.

When Low Deductibles Make Sense

Despite premium costs, certain circumstances favour low deductibles that minimise out-of-pocket insurance exposure when claiming.

1. High Claim Likelihood:

If your circumstances suggest frequent claims, paying higher premiums for lower deductibles proves economically sensible as you’ll likely meet deductibles multiple times.

2. Limited Financial Resources:

When affording even modest deductibles strains finances, prioritising low deductibles despite premium costs prevents a financial crisis when claiming.

3. Risk-Averse Personality:

Some people value predictability and minimal out-of-pocket exposure more than premium savings, making low deductibles worth the cost for peace of mind.

4. Financed Assets:

When financing vehicles or property, lenders often require low deductibles to protect their collateral interest.

When High Deductibles Make Sense

Conversely, many situations favour higher deductibles that significantly reduce premiums while managing out-of-pocket risk acceptably.

1. Strong Financial Position:

Substantial emergency savings enable comfortably absorbing higher deductibles, making premium savings from high deductibles attractive.

2. Low Claim History:

If you rarely claim, probability suggests you’ll seldom pay deductibles anyway, making lower premiums from high deductibles more valuable than minimal out-of-pocket savings from low deductibles.

3. Catastrophic Coverage Focus:

When primarily concerned with devastating losses rather than minor incidents, high deductibles for smaller claims combined with robust coverage for catastrophic losses provide cost-effective protection.

4. Premium Sensitivity:

When budget constraints make lower premiums essential, accepting higher deductibles trades increased out-of-pocket risk for manageable ongoing costs.

Documentation and Record-Keeping

Managing deductibles and out-of-pocket costs effectively requires organised documentation preventing disputes and ensuring proper credit for amounts paid.

- Keep Payment Records: Document all deductible payments with receipts, bank statements, and correspondence confirming amounts paid and to whom.

- Track Multiple Claims: If making several claims within policy periods, maintain records showing each separate deductible payment to prevent confusion or duplicate charges.

- Understand Coordination: When multiple insurance policies might apply to single incidents, understand how deductibles coordinate to avoid paying more than necessary.

Conclusion

Understanding the distinction between policy deductible amounts and broader out-of-pocket insurance costs empowers informed decisions about appropriate coverage levels and cost-sharing arrangements. While deductible explained concepts may initially seem complex, grasping how these mechanisms work and why they exist transforms them from mysterious burdens into strategic tools for optimising insurance costs.

Whether choosing higher deductibles to reduce out-of-pocket premium expenses or selecting lower deductibles that minimise claim-time costs, the key lies in aligning your cost-sharing in insurance with your financial capacity, risk profile, and personal preferences. Knowledge about insurance costs beyond premiums ensures no unpleasant surprises when you need coverage most.