About

Empowering Your Future with Expert Insurance Solutions

Nitin Jeswani, an experienced insurance advisor in Nagpur, has been helping clients with their insurance needs for over 20 years. Since starting in 2002, he has been dedicated to offering reliable and personalized insurance coverage. As an accredited Direct Insurance Consultant by IRDA, Nitin provides a wide range of insurance services from his Nagpur office. His goal is to ensure that each client gets the best coverage and support.

- Proven Track Record

- Wide Range of Products

- Rapid Claims Processing

- Centralized Operations

- Tailored Insurance Solutions

- IRDA Accreditation

Services

Types of Insurance

Corporate Insurance Policies

- Fire Insurance

- Loss of Profit Insurance

- Burglary and Money Insurance

- Marine Insurance

- Motor Insurance

- Package Policies (SHOP, OFFICE, JEWELLERS, BANK ETC.)

- Engineering Insurance

- Project Insurance

- Group employee health insurance

- Group Personal Accident (GPA)

- Employee Travel Insurance

- Directors & Officers Liability

- Errors & Omissions (E&O)

- Workmen Compensation

- Public Liability

- Product Liability & Recall

- Professional Indemnity

- Fidelity Guarantee Insurance

- Commercial General Liability (CGL)

- Clinical Trial Insurance

A. Property Insurance

- Fire Insurance

- Loss of Profit Insurance

- Burglary and Money Insurance

- Marine Insurance

- Motor Insurance

- Package Policies (SHOP, OFFICE, JEWELLERS, BANK ETC.)

- Engineering Insurance

- Project Insurance

B. Employee Benefit Insurance

- Group employee health insurance

- Group Personal Accident (GPA)

- Employee Travel Insurance

C. Liability Insurance

- Directors & Officers Liability

- Errors & Omissions (E&O)

- Workmen Compensation

- Public Liability

- Product Liability & Recall

- Professional Indemnity

- Fidelity Guarantee Insurance

- Commercial General Liability (CGL)

- Clinical Trial Insurance

Individual & Non-corporate Insurance Policies

- Accidental death

- Accidental permanent total disability

- Accidental permanent partial disability

- Loss of income

- Accidental hospitalization etc.

1.Hospitalization Coverages

2.Pre Post Expenses Covers

3.Consumables Item Cover

4.Restore Benefit

5.Cashless Services

6.Free health check up

7.Cumulative Bonus etc.

- Bike Insurance

- Private Car insurance

- Commercial goods carry vehicle

- Commercial passenger carrying vehicle

- class d vehicle

- Taxi car insurance

1.Medical Expenses

2.Loss of Baggage

3.Loss of Personal Belongings

4.Personal Accident

5.Trip Delay

6.Missed Connection etc.

A. Personal Accident Insurance

- Accidental death

- Accidental permanent total disability

- Accidental permanent partial disability

- Loss of income

- Accidental hospitalization etc.

B. Health Insurance

- Hospitalization Coverages

- Pre Post Expenses Covers

- Consumables Item Cover

- Restore Benefit

- Cashless Services

- Free health check up

- Cumulative Bonus etc.

C. Home Insurance

D. Vehicle Insurance

- Bike Insurance

- Private Car insurance

- Commercial goods carry vehicle

- Commercial passenger carrying vehicle

- class d vehicle

- Taxi car insurance

E. Travel Insurance

1.Medical Expenses

2.Loss of Baggage

3.Loss of Personal Belongings

4.Personal Accident

5.Trip Delay

6.Missed Connection etc.

Our USP

Why Nitin Jeswani

Comprehensive Coverage: Nitin Jeswani and team provide tailored insurance solutions that offer comprehensive coverage to meet the specific needs of his clients.

Extensive Market Knowledge: This knowledge enables him to offer informed advice and recommend the most suitable insurance options.

Personalized Approach: Nitin Jeswani and team take the time to understand each client's unique requirements, risk profile, and budget. He then crafts personalized insurance strategies that address their specific needs, ensuring maximum protection.

Strong Relationships: Nitin Jeswani values building long-term relationships with his clients. He fosters trust and maintains open lines of communication, ensuring that clients receive ongoing support and assistance throughout their insurance journey.

Proactive Claims Management: Nitin Jeswani goes the extra mile to assist his clients during the claims process. He and his team provide guidance, acts as a liaison with insurance companies, and ensures swift and fair resolution of claims.

Excellent Customer Service: Nitin Jeswani prioritises exceptional customer service. He and his team are responsive, attentive, and dedicated to delivering a positive and seamless experience for his clients, going above and beyond to meet their expectations.

These unique qualities make Nitin Jeswani a standout General Insurance consultant, providing his clients with reliable and customised insurance solutions while prioritising their needs and offering exceptional service.

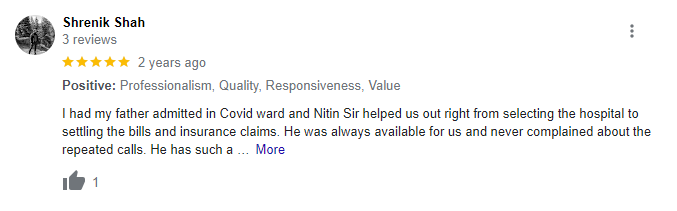

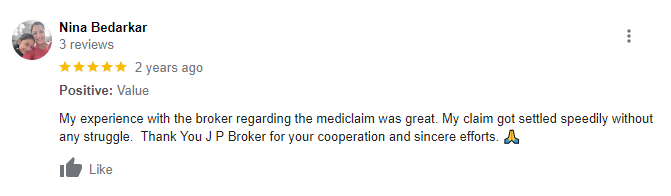

Testimonials

My Happy Customer

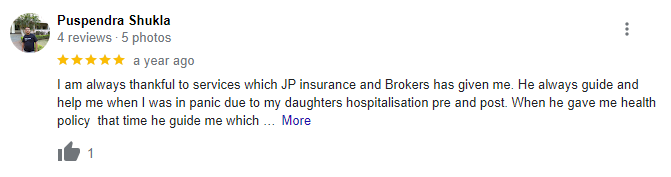

Pushpendra Shukla

Safex Pest Management.

Akhilesh Walokar

BGR Walokar Jewellers

Prafulla Rewatkar

Khamla Automobiles

Ankita Aditya Sarda

Sarda Dairy And Food Products Ltd.

Rashmi Kulkarni

Managing Director Zero Systems

M B Malewar

Designs Pvt.Ltd Architects, Planners & Interior Designers

Aleem .F Akolawala

AFSA Engineers Pvt. Ltd Director

Yogesh Khandelwal,

Founder of RAAVII Travel | Events | Conference

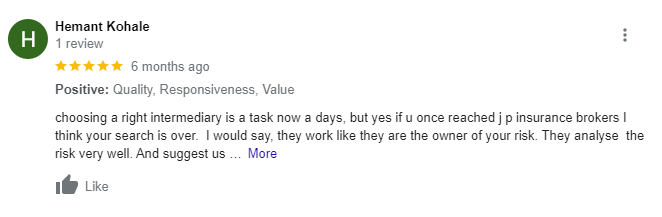

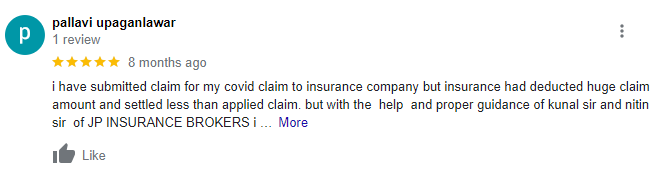

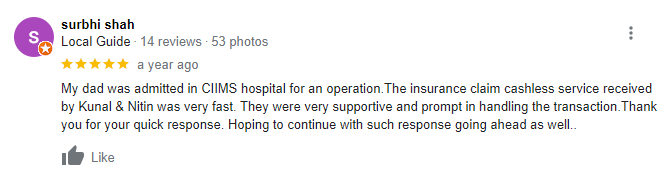

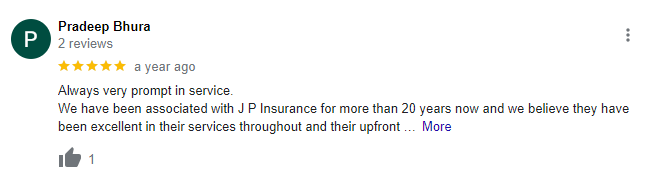

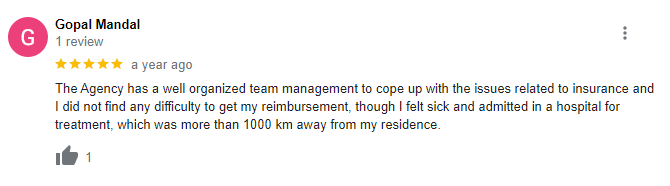

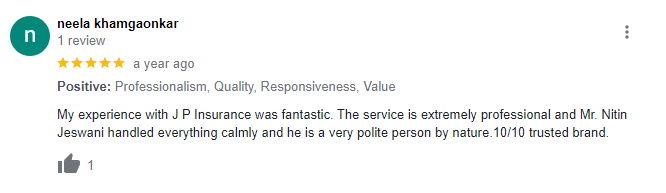

Reviews

Google reviews

Our Partners

Our Blog

Understanding Deductible vs Out-of-Pocket Expenses

Insurance terminology can feel deliberately confusing, with terms like deductibles, excesses, co-payments, and out-of-pocket maximums creating a maze of concept ...

Tips for Maximising Your Insurance Benefits

Anyone investing in an insurance hopes that they’ll never need to use it—yet when the need arises, we expect it to deliver peace of mind and robust protection. ...

We offer a wide variety of insurance plans, including options for life, health, retirement, and property coverage.

Insurance acts as a financial safety net for you and your family, protecting you from unexpected events such as accidents, illnesses, and other unforeseen circumstances.

The right amount of coverage varies based on factors like your income, financial objectives, and family needs. We can assist in evaluating your specific requirements.

We assess your individual situation and offer personalized advice to help you find the policy that fits your needs perfectly.

Our expertise, personalized service, and commitment to finding the best coverage options for our clients set us apart. We tailor each policy to meet your specific needs.

You can request a quote by contacting us directly through our website, phone, or visiting our office. We’ll provide a customized quote based on your requirements.

Filing a claim is simple. Contact our support team with the necessary documentation, and we’ll guide you through each step of the process.

Yes, we offer customized business insurance solutions, including liability, property, and workers’ compensation insurance, to protect your business.

You can easily update your information by contacting our customer support team.

If you miss a payment, please contact us as soon as possible. We’ll help you understand your options, including grace periods and policy reinstatement.

We recommend reviewing your policies annually or whenever there are significant changes in your life, such as marriage, having children, or purchasing a new home.

Many of our insurance policies come with tax benefits. Our advisors can guide you on how to maximize these benefits based on your situation.